When money is tight, thinking about saving money can be stressful. Don’t give up! There are still quite a few ways that you can start a savings plan.

When money is tight and you are barely able to pay the bills, probably the last thing on your mind is to start a savings plan. I mean even thinking about trying to save money can be stressful.

Even more stressful, however, is not having any money saved for vacations, Christmas, or the dreaded emergency that pops up.

Don’t throw in the towel just yet! There are quite a few ways that you can, no matter what your financial situation, start saving.

6 Ways to Start a Savings Plan

Here are a few easy ideas to help you take back your savings and start a savings plan 😉

Start a spare change jar

Many of you probably already have a spare change jar that you empty your pockets into each day. If you don’t, you definitely should. It’s hard to believe, but that change sure does add up fast.

I’m always finding change in the washer and dryer that I guess I missed before doing the laundry. Oops! So I’m adding a jar in the laundry room. That way I’ll actually have somewhere to put all the change I find, instead of just in the pockets of the pants that I am currently wearing.

Depending on the size of the container you choose, you might end up with a couple hundred dollars from what you think is worthless change each day!

Set up automatic payroll deductions

A pretty traditional, easy way to save is to take a portion of each paycheck and have it automatically transferred to your savings account if you use direct deposit. Of course the money can also be transferred by you if you don’t use direct deposit and receive a paper check each week.

Make a few extra payments…to yourself!

Are you close to paying off a loan or credit card? Make one or two extra payments of that amount into your savings account. You’ve already been making the payment for months or even years so those few extra payments shouldn’t hurt you too much!

Reward (or punish) yourself

How about paying yourself for good (or penalizing yourself for bad) behavior?

If one of your New Year’s resolutions is to get healthier this year, you can put $1 in your fund each time you take a walk. Or if you are trying to kick a bad habit, charge yourself $1 each time you slip and add that to your fund too.

Bank your coupon savings

Another tactic to try is banking your savings. You can learn ways to save on any purchase here.

When you go shopping and use coupons or take advantage of store sales, you’ll see those savings listed on your receipt. Add those shopping trip savings to your savings fund.

You can also add money saved using Ibotta, SavingStar, Swagbucks, and Ebates this fund too 😉

What a great way to see just how much money you are saving at the store while banking some cash!

Take the 52 week savings challenge!

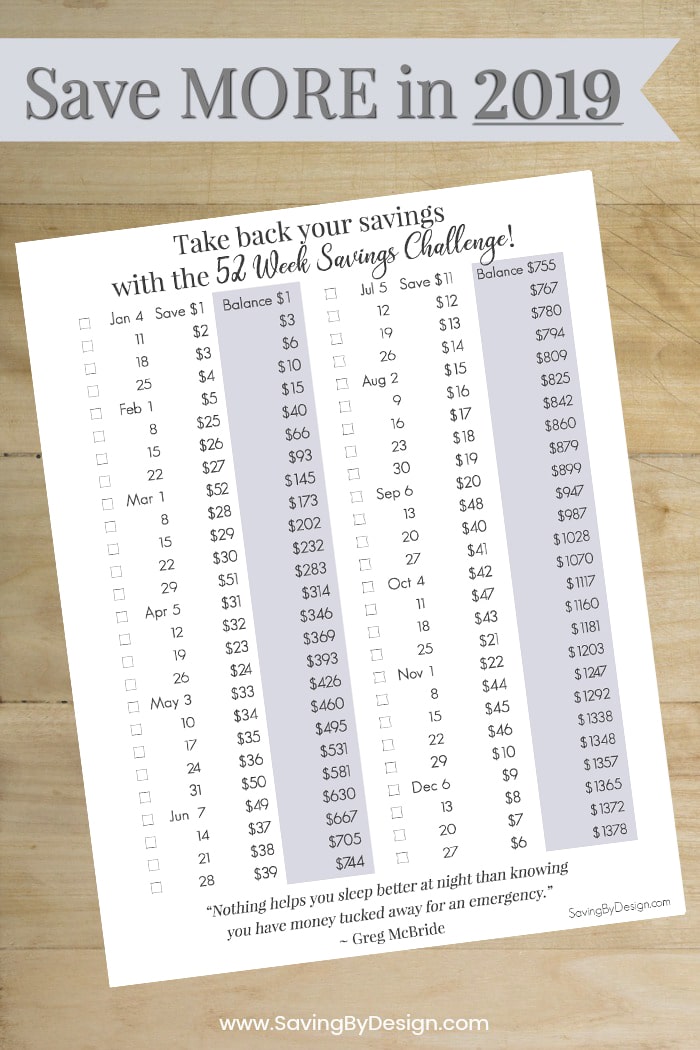

Finally, one of my favorite ways to save ends up adding $1378 to your savings account (or shoe box) over the course of 1 year. The 52 Week Money Challenge looks to have been started by Kassondra Perry-Moreland who owns the 52 week Money Challenge facebook group.

In this gradual plan you start by adding $1 the first week, $2 the second week, and so on up to $52 the final week of the year. After 52 weeks you’ll end up having saved close to $1400! Want to save more, double your weekly deposit. Don’t need quite as much, cut your deposit in half.

Since saving $50 per week near Christmas (or $50 right after Christmas if you choose to do the plan in reverse) can be pretty rough, I’ve created an adjusted version of this savings plan which accounts for Christmas, other holidays, and summer vacations.

Take a look…

<< Get your 2018 Adjusted 52 Week Savings Challenge Worksheet >>

I added the weekly dates for 2019, all Fridays since we should be payed by that day each week. When the time comes simply put aside the amount in the “Save” column for that week.

You’ll find a running balance under the “Balance” column to see how much you have saved to date. There are also handy little check boxes in front of each week to help you keep track.

Don’t forget to pat yourself on the back with each check mark you make! 🙂

While trying these savings methods in combination will rack up your savings the fastest, implementing just one will definitely help you keep more money in your pocket.

Hi Kara!

I have used your 52-week challenge before and really enjoyed saving that way.

I’m trying to print this one for this year but when I go to print, it pops up with having Xs instead of boxes for check marks.

Could you please help me with this?

Thank you very much!

– Alina

Hi Kara,

When I go to print out the plan it’s not how it looks here. Could you please change change Xs to check boxes?

I hope to hear from you soon.

Thank you!

– Alina

Hi Alina! So sorry I just saw your comment! I took a look and it seems to be printing ok for me. Try printing from this link: https://savingbydesign.com/wp-content/uploads/2016/12/2017-Adjusted-52-Week-Money-Challenge.pdf

I’ll also send you an email with the file. Hopefully one of those work 🙂

Hi Kara,

Alina is here again 🙂

Do you have a plan for 2019 yet?

Also, would you be able to make one with adding by $5 each week?

Thank you very much! I really like the design of this saving plan and I’ve shared this with some of my friends too 🙂

Hope you are having a wonderful holiday season.

– Alina

Hi Alina!! Thanks so much for coming back! Happy 2019! 🙂

I hope to have the 2019 plan out today or by the end of the week at the latest. As usual I didn’t get it done earlier like I would like lol.

I’ll work on a $5 version too!